- #BUSINESS LENDING BLUEPRINT HOW TO#

- #BUSINESS LENDING BLUEPRINT PLUS#

- #BUSINESS LENDING BLUEPRINT PROFESSIONAL#

It’s also fascinating to realize that a company credit score may differ from your personal credit history, which is a massive plus for any business owner.

#BUSINESS LENDING BLUEPRINT HOW TO#

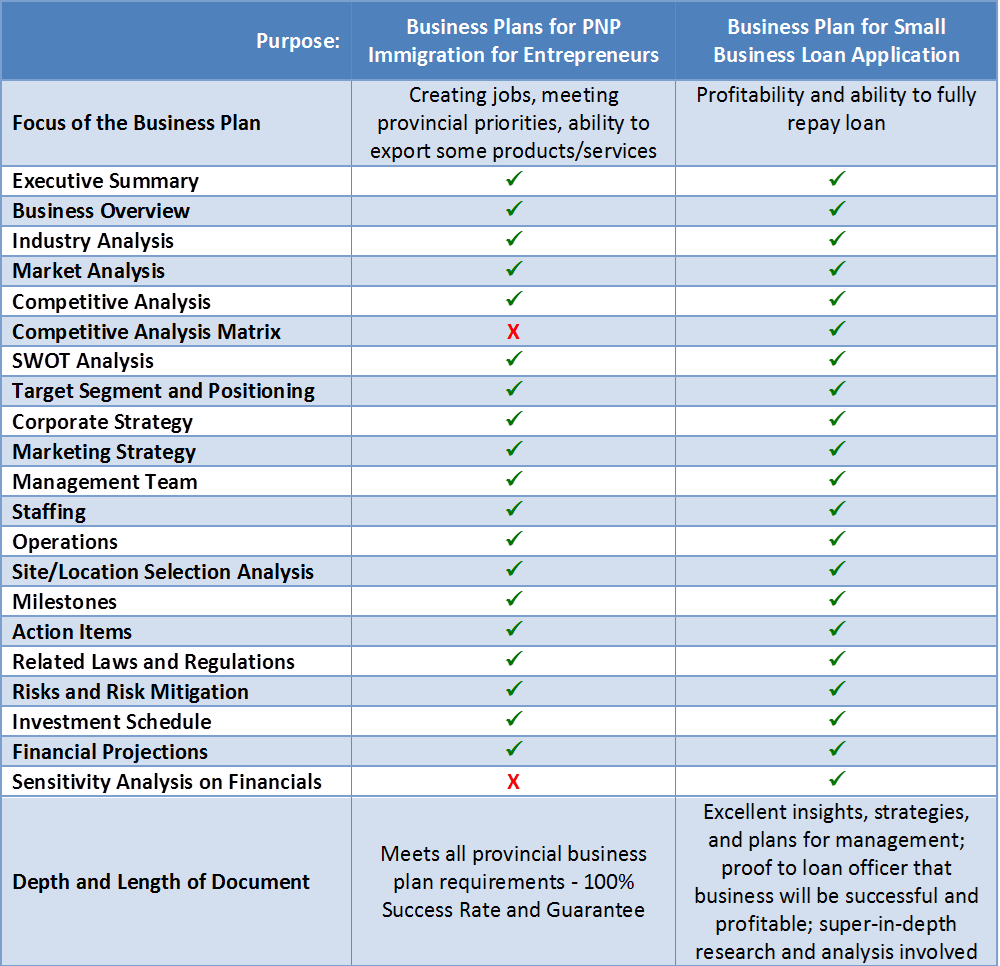

They teach people how to enhance their business credit to get loans more quickly. Hopefully these help, feel free to ping if you have additional questions. The Business Lending Blueprint initiative targets business loan officers and the clients of their brokers. A doctor can always make a loan payment because they can go pick up some hours someplace over a weekend. New practices are fantastic places for loans as they always need some new gadget or equipment that costs 50 - 250K and they are fantastic credit risk.

#BUSINESS LENDING BLUEPRINT PROFESSIONAL#

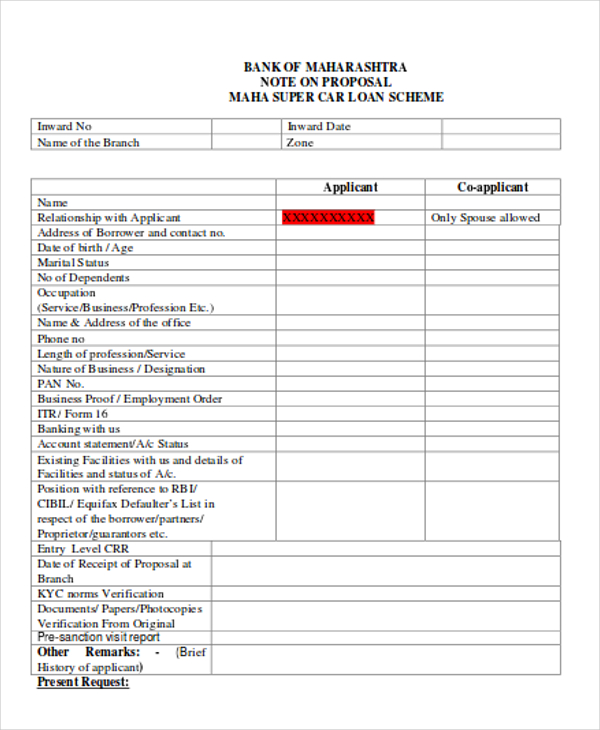

Unless these businesses have significant history of success (Anthony Bourdain is coming to you for a loan to open a new restaurant) the chances of them being approved for a loan is small or the terms will be onerous and/or loan size will be so small that it won't even be worth discussing with the customer.ĭo Target: Businesses with 3+ years of track history, asset intensive businesses (dealerships, distribution companies - assets make collateral if unencumbered), predictable and/or seasonal businesses, and my personal favorite professional businesses ESPECIALLY new doctor's and dental practices. Now that I have laid out some risks here is who you should and should not target:ĭon't target: Restaurants, Nail Salons, Bars, Entertainment-related businesses (think clubs, music venues), and businesses with less than one year of history. Lending to small businesses is a hard business from a risk standpoint, it's all the fun of consumer lending but levered up with a high beta to the overall economy. Now that's OK if you are working for a national or regional bank - that's your job, but if this a side gig be VERY careful. I don't know if you will be doing SB lending by itself, as a small business banker, or if as a part of other small business sales such as office supplies, websites, HR expertise, etc, but be aware if you make a commitment to a customer to help get them a loan you automatically put your reputation and business on the line. The most important thing you should understand in the multiple analysis over a number of years we completed, the number one thing we did as a bank to LOSE a customer was NOT extending a loan. Courses 57 View detail Preview site How To Start A Brokering Business - Business Lending 1 week ago. Courses 475 View detail Preview site Business Lending Blueprint Reviews: 10 Secrets You Should. Videos of Commercial Capital Broker Training Business 1 week ago. How you approach your sales is going to depend on if you are just small business banker for a regional bank or you are selling other SB products and are just making a referral and receiving a finders fee. Related Commercial Capital Broker Training Business Lending Blueprint Revie Online. How you approach your sales is going to depend on the organization you are solicit on behalf. No expertise, No experience needed, Work from home or office, No overhead, No telemarketing or cold calling, Have access to lenders, Be your own boss, Can be built on part time basis., Access to multiple. Step by step training to go from 0 to 25,000+ per month. My answer to you is two-fold: what businesses need loans versus what businesses where you want to lend. Oz Konar Business Lending Blueprint 2021.

Little background about myself, I was previously the head of small business sales performance for a large national bank.

0 kommentar(er)

0 kommentar(er)